|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home with Same Lender: A Step-by-Step Guide to Understanding the Main BenefitsRefinancing your home can be a complex decision with numerous factors to consider. When contemplating refinancing, many homeowners wonder whether they should refinance with the same lender or explore other options. This guide aims to provide a comprehensive understanding of the benefits of refinancing with your current lender. Understanding Refinancing with the Same LenderRefinancing with the same lender can offer unique advantages. It involves negotiating new loan terms with your current mortgage provider, which can streamline the process and potentially offer cost savings. Potential Cost SavingsRefinancing with the same lender may reduce closing costs. Often, lenders are willing to offer competitive terms to retain your business. Be sure to explore todays home refinance rates to ensure you're getting the best deal possible. Streamlined ProcessSince your current lender already has your information on file, the paperwork and approval process may be faster and more efficient. This can be particularly beneficial if you're looking to refinance quickly. Steps to Refinance with the Same Lender

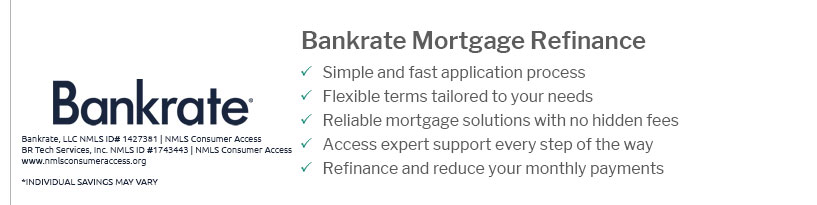

Remember, it's essential to review both your current lender's offer and alternative options. Check out conventional refinance rates for a comprehensive comparison. Considerations Before RefinancingCredit Score ImpactRefinancing will result in a hard inquiry on your credit report. Ensure your credit score is in good shape before applying to maximize your chances of securing favorable terms. Loan Terms and FeesEvaluate the loan terms, interest rates, and associated fees to ensure refinancing aligns with your financial goals. Calculate the break-even point to determine when you'll recoup the refinancing costs. FAQ

https://www.compmort.com/can-you-refinance-with-the-same-lender/

Benefits of refinancing with the same lender - Streamlined process - Potential for lower fees or perks. Some lenders may offer reduced or waived ... https://housenumbers.io/blog/refinance-mortgage-with-same-lender/

The simple answer to this question is that yes, you can refinance your mortgage with the same lender. https://refi.com/can-you-refinance-with-same-bank/

Cons of Refinancing With the Same Lender - You could forgo a lower rate. If you don't check with other banks and lenders before refinancing, you ...

|

|---|